It is possible for just about everybody to achieve financial success. Getting there is usually not a matter of financial wizardry. By following some basic principles, you can make your financial dreams come true:

Set Objectives

Goal setting is the foundation of achieving financial success. If you don’t have a target to shoot for, how can you expect to hit it? By writing down your goals, you will clarify them and establish your personal and financial priorities. Be specific when setting goals. For example, instead of having a goal to reduce debt, set a goal to reduce debt by a certain amount by a certain date.

Pay Yourself First

This is the best way to build wealth. It simply means that your savings come off the top of your paycheque instead of from what little, if any, is left at the end of the month. A good starting point is 10% of your gross earnings monthly.

A good way to establish and maintain a savings plan is to have a set amount automatically taken from your bank account each month. Like a loan payment, you get used to the regular commitment.

Protect Your Income

Your most valuable asset is not your home, your business or your RRSPs – it is your ability to earn an income. If you are 35 and earn $60,000 per year, your total earnings, assuming a 2% annual salary increase, would be about $2.9 million by age 65.

Even a short-term disability, resulting in six months without income, can wipe out years of savings. Adequate disability insurance provides an income when an injury or illness prevents you from working.

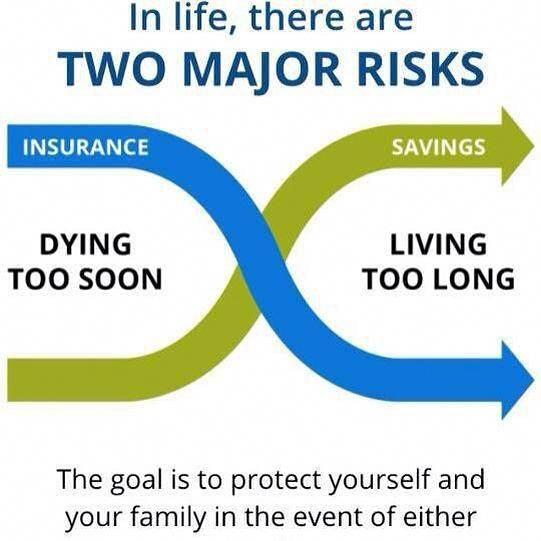

Protect Your Dependents

For most of us, nothing is more important than the security of our family. A top priority is ensuring they will be able to maintain a reasonable standard of living, even if you’re not around to enjoy it with them. Life insurance provides a capital base to replace lost income when you die. It also allows for the proper winding down of your estate by eliminating all debts and paying all taxes.

After all, your debts should not last longer than you do.

Maximize RRSP Deposits

Your RRSPs are the cornerstone of your retirement plan. Not only do they offer a valuable tax deduction, the power of tax-deferred compounding interest can be dramatic. For example, $6,000 per year to an RRSP at 7.5% will grow to about $620,396 in thirty years.

Instead of spending your RRSP tax refund, use it to pay down your debts or invest it. This is one of the most powerful methods available for building wealth.

Avoid Personal Debt

Too much personal debt is the most serious obstacle to reaching your financial goals. Even modest levels of debt can put a drain on your cash flow, leaving less to invest. Since interest paid on personal debt, such as mortgages and credit cards, is usually not tax deductible, paying it off is one of the best investments you can make.

Want help reaching your financial goals?

Copyright © 2019 Life Letter. All rights reserved. For informational purposes only and is based on the perspectives and opinions of the owners and writers only. The information provided is not intended to provide specific financial advice. Readers are advised to seek professional advice before making any financial decision based on any of the ideas presented in this article. This copyright information presented online is not to be copied, or clipped or republished for any reason. The publisher does not guarantee the accuracy and will not be held liable in any way for any error, or omission, or any financial decision.