When it comes to making financial decisions most people focus on eitheror scenarios; that is making a tactical decision that may or may not reflect a larger financial strategy or wealth accumulation context.

We often see these types of isolated, one-off decision choices in media articles that pose dilemmas such as: Is it better to invest in an RRSP or pay down your mortgage? Should you take your tax refund and invest in an RRSP or go on Vacation? Are TFSA’s better than RRSPs? Should you pay off your credit card balance or invest in an RRSP? You get the picture.

It is far easier for most people to deal with one small decision than to balance a number of inter-related decisions and their potential impacts. Most people have busy lives with complex decisions to make in any number of areas of their lives so the default – when it comes to their financial affairs – is to make the simple or quick decision. That way they can get back to doing the other things that really matter most to them.

The consequence is that they often sacrifice longer-term benefits for the expediency of making quick and immediate decisions. For example, many people have a strategy of first paying off their mortgage because they believe that having consumer debt is expensive in terms of after-tax dollars. Once the mortgage is paid off then they intend to focus on building retirement assets through RRSPs.

Then life gets in the way, things change, they buy several houses and keep getting larger and larger mortgages that never seem to be paid off (especially in Toronto, Vancouver, Calgary, etc.). Suddenly they wake up at age 55 with a medium sized mortgage, few RRSP savings and only 10 – 15 years to go before retirement.

In fact, it is not uncommon to see Baby Boomers increasingly retiring with a mortgage which was never part of their financial strategy. Worse, they might even face a lay-off, plant closure or job loss that sees their incomes reduced just as they were going to get serious about putting the maximum effort into saving money for retirement.

Instead of focusing on one financial idea, the alternative is to have a set of financial objectives that you can attend to and care for. The idea is to allocate money to them all over time and to recognize those financial objectives that have been neglected and are in need of your attention.

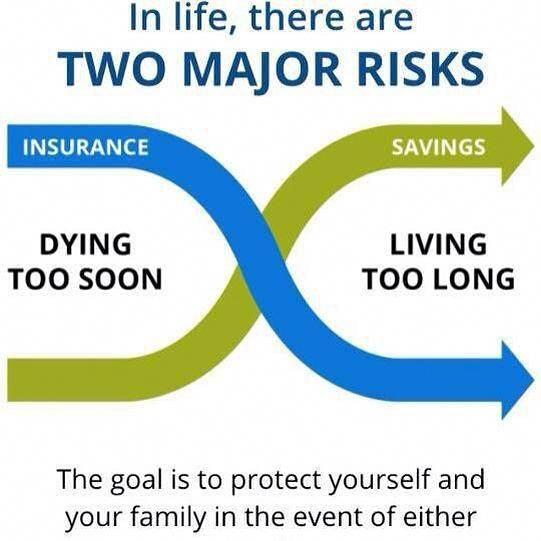

For example, you might have as objectives some of the following: build up retirement savings, pay down debt, go on an annual vacation, save for children’s education, have a rainy day fund, have some mad money that can be spent as you wish, build wealth through a TFSA, manage life’s risks through various insurance programs, save for a house or renovate a house, save for a car and so on.

None of these is better or more important than any other item as they may all be important to you as you live your life today while building financial security for the future. One way to allocate money is to look at those areas that have not seen any funding for a couple of years or so.

Call us today to review your financial goals and to discuss those areas in need of attention as you aim to live a fulfilling life!

Do you have questions about money management? Contact our office today!

Copyright © 2015 AdvisorNet Communications Inc., under license from W.F.I. All rights reserved. This article is provided for informational purposes only and is not intended to provide specific financial advice. It is strongly recommended that the reader seek qualified professional advice before making any financial decisions based on anything discussed in this article. This article is not to be copied or republished in any format for any reason without the written permission of AdvisorNet Communications. The publisher does not guarantee the accuracy of the information and is not liable in any way for any error or omission.